The crypto market is once again showing exciting developments. While Bitcoin (BTC) fluctuates between strong price movements, Ethereum (ETH) and Ripple (XRP) provide new impetus for investors. From impressive investments to regulatory progress – here are the most important developments of the last few days.

Bitcoin: Between turbulence and long-term stability

Bitcoin experienced sharp price fluctuations in the last few days, with a range of $94,200 to $101,430. Two major events led to liquidations of futures positions worth over $1 billion, including a crash on December 9 that wiped out $2.9 billion in leveraged positions. Despite this volatility, the derivatives market is showing a healthier trajectory with less excessive leverage.

Open demand for BTC futures fell eight percent, while funding rates since Price fall remained stable. The futures premium remains above the spot price, a sign of optimism among investors. Institutional players dominate market moves, suggesting accumulation in the long term.

A special milestone was achieved by MARA Holdings, which purchased 11,774 Bitcoin worth $1.1 billion on December 10th. The company now holds 40,435 Bitcoin with a total value of $3.92 billion. MARA was also the first public Bitcoin miner to achieve a hashrate of 50 exahashes per second.

Using the proceeds from its zero-coupon convertible notes offerings, MARA has acquired 11,774 BTC for ~$1.1 billion at ~$96,000 per #bitcoin and has achieved BTC Yield of 12.3% QTD and 47.6% YTD. As of 12/9/2024, we hold 40,435 BTC, currently valued at $3.9 billion based on a… pic.twitter.com/2uvnrhbxaP

— MARA (@MARAHoldings) December 10, 2024

Ethereum and Ripple: New investments and stablecoin news

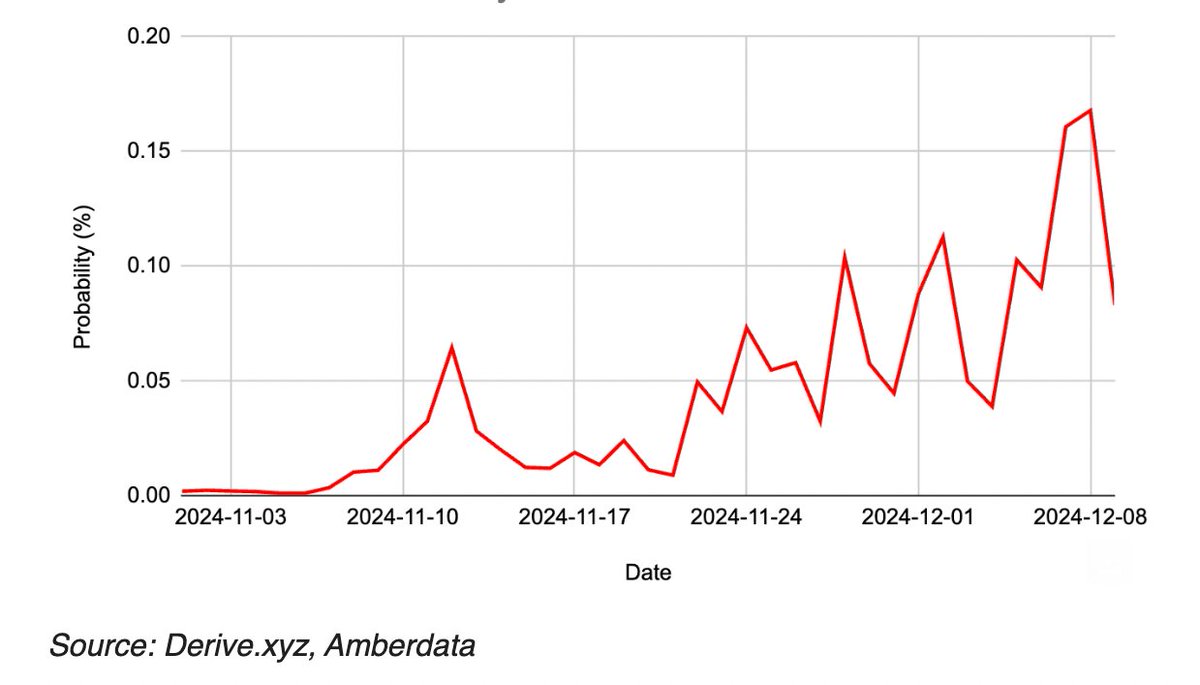

Ethereum faces mixed prospects. According to the onchain protocol Derive, the probability of reaching the $5,000 mark by the end of 2024 is less than ten percent. The current course of 3,669 US dollars would have to increase by 37 percent. Still, institutional investors like the Fidelity Ethereum Fund, which invested $202 million in ETH on December 10, are investing.

Ripple is also making headlines: The company received approval from the New York Financial Supervisory Authority (NYDFS) for its RLUSD stablecoin. This should be secured by USD deposits and other liquid assets. First tests on the XRP– and Ethereum networks are already running, and partnerships have been established with exchanges such as Uphold and Bitstamp. Ripple estimates that RLUSD could reach a market cap of $2 trillion by 2028.

Conclusion: The crypto market remains dynamic

Whether it’s institutional accumulation in Bitcoin, regulatory advances in Ripple or new investments in Ethereum – the crypto sector is constantly evolving. Despite short-term volatility, the long-term potential remains impressive. The next few months could bring further exciting developments.

If you liked this post, then check out my YouTube channel MissCrypto over! There I regularly share exciting analyses, current news and helpful tips about Bitcoin, Ethereum and the world of cryptocurrencies. I look forward to your visit – and don’t forget to subscribe to the channel!